UK inflation rates have recently seen a large rise in response to a variety of factors.

Understandably, many doctors are now thinking about how savings and investments keep pace with inflation. Interest and gains on investments often cause tax charges.

Partner Richard Norbury looks at practical and tax issues to consider with common investment areas

Due to high income tax and potential tax charges on pension growth, many doctors trading as limited companies will not be withdrawing all the available funds from the company.

If you are in this position and the money is building up to sizeable amounts, then these sums can be considered for investing.

Savings

Personal savings attract interest which is often taxable at your usual rate of income tax.

Many doctors will not have the benefit of using their personal allowance or starting rate for savings due to the amount of other income earned in their main job.

However, most will have the personal savings allowance available as follows:

- Basic-rate taxpayers: first £1,000 tax free

- Higher-rate taxpayers: first £500 tax free

Additional rate taxpayers – those earning over £150,000 a year – are not entitled to any personal savings allowance.

Rising interest rates on savings will push more savers into paying tax.

For individuals, there are financial products that may offer tax-free interest and capital gains, where appropriate, such as the individual savings account (ISA).

In relation to companies, there are no tax-free amounts and you will pay corporation tax on your savings interest at the relevant rates, which are planned to rise in April 2023 for any firm earning more than £50,000 profit a year.

Therefore, with higher interest and inflation rates, it becomes harder to ensure that savings do not lose value in real terms due to the Government taking its tax cut from income but giving no tax relief on cost-ofliving increases for your household expenses.

Stocks and shares

Another common form of investment is that you may hold some stocks and shares or a portfolio of shares.

If held personally, tax liabilities on this type of investment will come in two main forms: income tax on dividend income and capital gains tax when you sell investments.

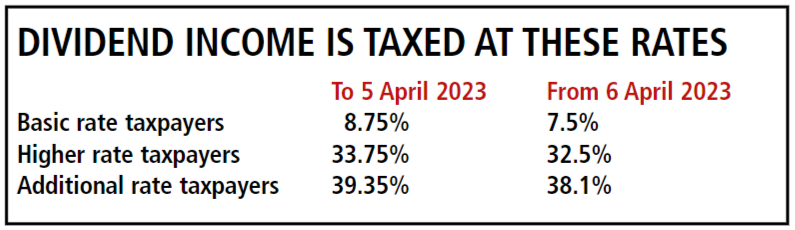

Dividend income is taxed at the rates shown in the box at the bot-tom of this page.

For capital gains tax, each individual has an annual allowance of £12,300. This means you can make gains of up to this amount each tax year without paying any tax.

Any gains over this amount are taxed depending on the type of asset and if you are a basicrate or higherrate taxpayer. But, typically, on stocks and shares you would expect to pay 10% tax for a basicrate taxpayer and 20% for a higherrate taxpayer.

In addition to ISAs, for individuals there are other investment products available that attract tax relief such as enterprise investment scheme (EIS).

These investments attract tax relief to encourage investment in new or startup companies, so there is usually more risk associated with these.

Due to their nature, advice from an independent financial adviser is essential before investing.

Companies can also invest in stocks and shares, but need to take care that this does not reclassify the status of the company from a trading company – essentially companies used for private practice income – to an investment company, which can impact on corporation tax rates and longerterm strategies that may be in place.

With this in mind, it is better to take professional advice from an accountant, who can consider your needs on a case-bycase basis and set up the relevant structure accordingly.

Dividends paid into your company from other companies often qualify for exemption from corporation tax, but this should obviously be checked on a case-by-case basis. In relation to capital gains tax, there is no annual allowance exemption and tax is payable on gains at the relevant corporation tax rate applicable.

Cryptocurrency

Many doctors reading this will have invested, or know someone who has invested, in cryptocurrency.

In the UK, there is no specific tax applicable to cryptocurrency and, instead, it will be taxed via the existing capital gains tax rules or income tax.

Generally speaking, the process of buying and selling cryptocurrency is subject to capital gains tax in much the same way and tax rates as explained under the stocks and shares category of this article.

However, there are instances where HM Revenue and Customs will consider that cryptocurrency should be taxed under income tax, but this will generally be when you are being paid in cryptocurrency for work performed or if you are actively mining tokens.

Investing in residential property

This is a complicated area and it needs to be considered on a case-bycase basis. Many of you will already own or be thinking of investing in residential property and a common question is whether that investment should be owned personally or via a limited company.

Personally owned property has seen changes in tax legislation over the recent years, including the removal of full tax relief on mortgage interest payments for higher-rate taxpayers and the introduction of additional stamp duty for individuals purchasing more than one residential property – including your own home.

Tax is payable at the usual income tax rates on the rental profits, but higher-rate taxpayers do not get tax relief on the full amount of interest on mortgages, instead receiving an equivalent relief of a basic rate taxpayer while the income is subject to higher rate tax.

A 3% stamp duty surcharge is added on to the purchase of additional homes, which is on top of the usual stamp duty rates applicable depending on the overall purchase price of the property.

Often residential property is owned with other family members, meaning not all of the rental profits are taxed upon you.

Capital gains tax is payable when you sell the property and, as with stocks and shares, this depends upon whether you are a basic rate or a higherrate taxpayer. The difference is that the tax rates applicable to gains on residential property are 18% and 28% respectively.

The annual allowance of £12,300 per individual still applies. Further reductions to the capital gain assessed may be available if you have lived in the property at any time.

In relation to companies, various different structures are used and the best fit would depend on your own circumstances, bearing in mind whether a lender is involved or you are using funds available.

Stamp duty is similar to that charged on second homes in that there is an additional 3% surcharge added to residential homes purchased via a company. This is a consideration for anyone thinking of moving a personallyowned investment property into a company.

Mortgage companies may charge an additional premium on interest for their perceived risk of ownership via a limited company, but it is worth noting that any interest is fully deductible against the rental profits.

A capital gains tax liability arises when you sell the property and, as with stocks and shares, there is no annual allowance exemption and tax is payable on gains at the relevant corporation tax rate applicable.

Additional tax

If ‘high value’ residential property is owned within a limited company, additional tax is sometimes payable which is known as an annual tax charge for enveloped dwellings.

The current threshold for this to apply is £500,000. While not all properties of this value are subject to this tax, at the very least, additional returns and exemptions need to be applied for on an annual basis.

When it comes to comparing personal and corporate ownership of property, it is easy to demonstrate that you will pay less tax on the rental profits through a company.

However, given that capital gains tax is payable on the increase in value and as a shareholder of the company you will need to extract those funds, the decision is complex and will often not have a clear answer.

When considered over the life-time of ownership, the savings on rental profits can often be out-weighed by the additional capital gains tax or income tax from extraction of the profits from the company. As always, speak to your accountant to discuss your individual circumstances before committing.

The vast majority of investments put your capital at risk, which may not be covered by the financial ser-vices compensation scheme.

Therefore, it is essential that you take advice from an independent financial adviser prior to investing and also make your accountant aware of your intentions so they can advise you on tax and accounting related matters.

Written for the Independent Practitioner Today, December / January Issue.